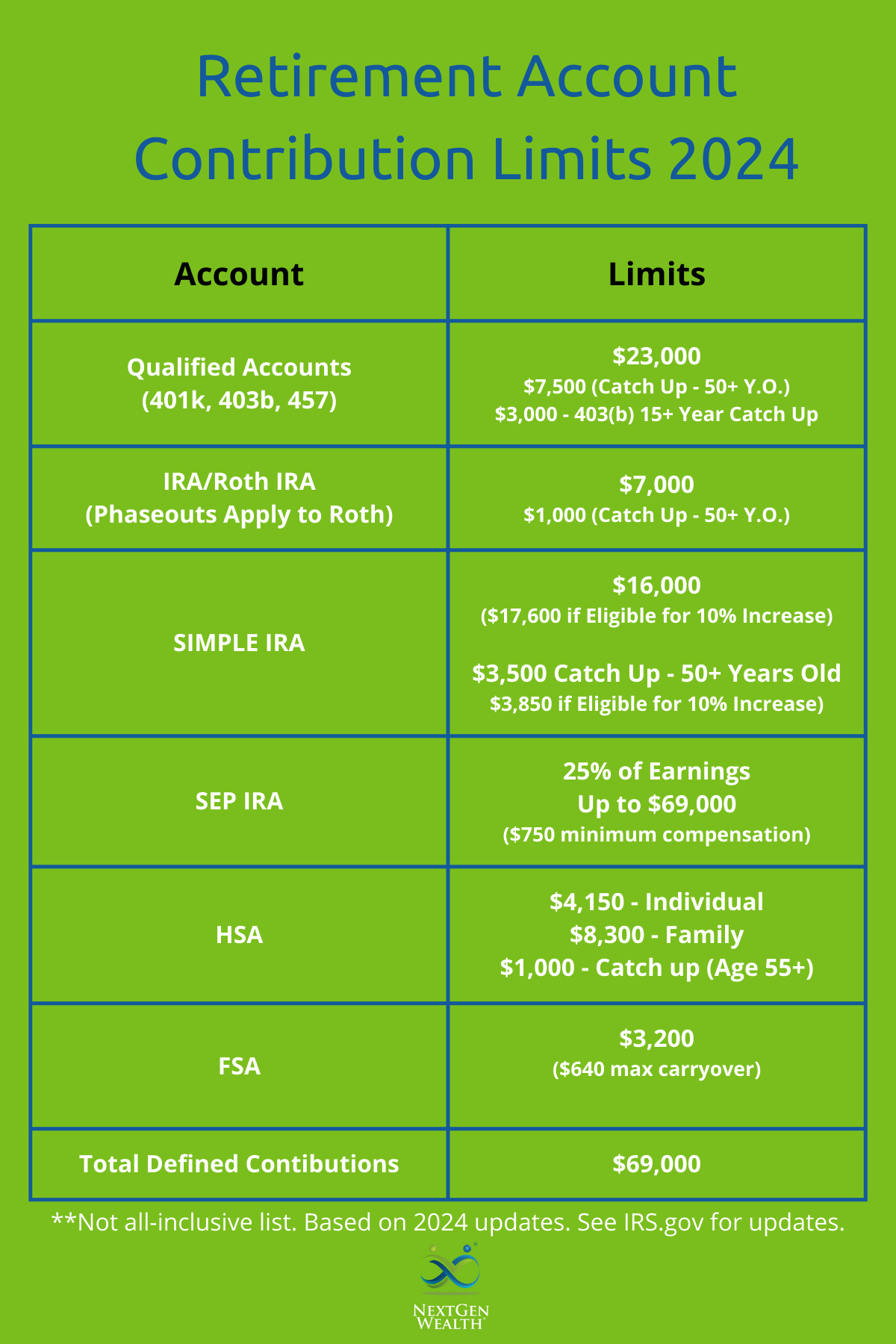

401k Roth Ira Contribution Limits 2024 Over 50. The roth ira contribution limit for 2025. These limits will remain the same in 2025.

For most individuals, the roth ira contribution limit in 2024 and 2025 is the smaller of $7,000 or your taxable income. The annual roth ira contribution limit in 2024 is $7,000 for adults younger than 50 and $8,000 for adults 50 and older.

401k Roth Ira Contribution Limits 2024 Over 50 Images References :

Source: brearysimonette.pages.dev

Source: brearysimonette.pages.dev

Roth Ira Limits 2024 Irs Lindy Petrina, Contribution limits for roth iras.

Source: collievjohnath.pages.dev

Source: collievjohnath.pages.dev

Roth Ira Contribution Limits 2024 Rodi Robinia, $6,500 plus an additional $1,000 for employees age 50 or older in 2023;

Source: rivkahwdoti.pages.dev

Source: rivkahwdoti.pages.dev

Roth Ira Limit 2024 Cal Iormina, If you're age 50 or.

Source: kelsyqrosina.pages.dev

Source: kelsyqrosina.pages.dev

Roth Ira Max Contribution 2024 Over 50 Fae Kittie, If you're age 50 or.

Source: tishaazquintina.pages.dev

Source: tishaazquintina.pages.dev

2024 Ira Contribution Limits Chart 2024 Maude Sherill, If you're age 50 or.

Source: jessibfilippa.pages.dev

Source: jessibfilippa.pages.dev

Roth Contribution Limits 2024 401k Over 50 Caria Corrina, The maximum amount you can contribute to a roth ira for 2025 and 2024 is $7,000 if you're younger than age 50.

Source: koreyysabel.pages.dev

Source: koreyysabel.pages.dev

Roth Contribution Limits 2024 401k Over 55 Dona Rochella, Contribution limits for a roth 401(k) are the same as for a traditional 401(k).

Source: www.aiohotzgirl.com

Source: www.aiohotzgirl.com

2023 Retirement Plan Contribution Limits 401 K Ira Roth Ira Free, The 2024 maximum contribution to a roth ira is $7,000.

Source: joyebmarsiella.pages.dev

Source: joyebmarsiella.pages.dev

Max Roth 401k Contribution 2024 Over 55 Flo Consuela, The roth ira contribution limits are $7,000, or $8,000 if you're.

Source: elissabrenelle.pages.dev

Source: elissabrenelle.pages.dev

401k And Roth Ira Contribution Limits 2025 Glenn Kalinda, If you're age 50 or.

Posted in 2024